- August 18, 2015

- Len Riley

- Reading Time: 6 minutes

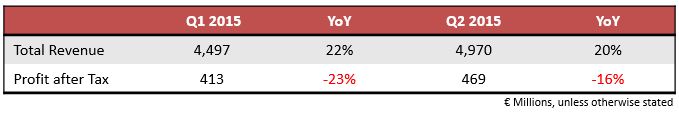

SAP confirmed they met their revenue expectations for the second quarter of 2015 with total revenue growing 20% year-over-year. CFO, Luka Mucic, reaffirmed SAP is on pace to deliver on its prior guidance for the full year.

SAP confirmed they met their revenue expectations for the second quarter of 2015 with total revenue growing 20% year-over-year. CFO, Luka Mucic, reaffirmed SAP is on pace to deliver on its prior guidance for the full year.

A thorough review of SAP’s second quarter financials coupled with UpperEdge’s recent SAP engagement experience makes for some compelling observations. As customers assess their relationships with SAP and proceed into negotiations during the second half of the year, UpperEdge recommends SAP customers consider the following:

- Despite the growth of SAP’s Cloud revenue, the primary reason for SAP’s success in the second quarter can be attributed to SAP’s Software Support and Services revenue growth.

- In order for SAP to meet its full year guidance, strong revenue performance in Software Licensing and continued growth in Cloud Subscriptions and Support will be required.

- SAP’s Enterprise Sales organization will be required to meet second half challenges without the services of Elizabeth Baker, former SVP of Enterprise Sales who departed SAP in June.

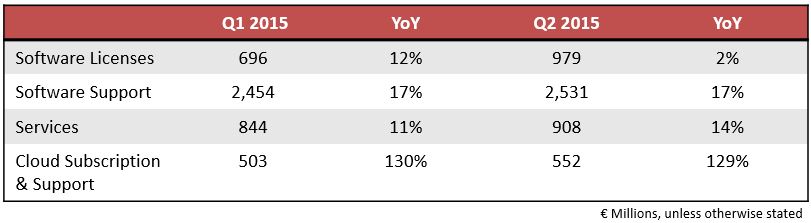

Numbers At a Glance

Revenue by Line of Business

Key Considerations & What They Mean For You

Cloud Subscriptions & Support

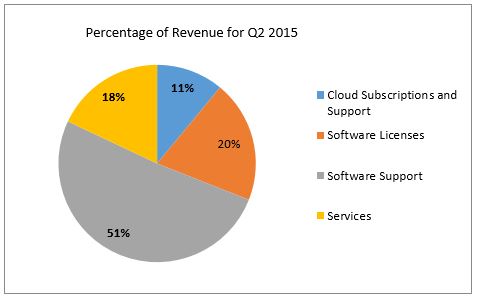

Although Wall Street’s attention and SAP’s marketing efforts have been focused on SAP’s 129% year-over-year revenue growth in Cloud Subscriptions and Support, it is important to note this accounted for only 11% of SAP’s total second quarter revenue.

What Customers Should Expect During Cloud Negotiations

Despite SAP’s motivation to maintain Cloud Subscription and Support revenue growth, customers should not anticipate an effortless negotiation. UpperEdge recommends executives negotiating with SAP prioritize the following three items as part of top-to-top discussions. Delivering these key themes is critically important as the pricing and business practices related to SAP’s Cloud solutions have not been fully integrated or harmonized amongst SAP’s account, contract and legal teams.

- Lack of Transparency & Predictability: SAP pricing across its Cloud solutions are inconsistent and lack the transparency required for customers to predict future cost and renewal term protections.

- Inadequate Service Levels: Customers should anticipate proposed service levels will not meet availability requirements for Tier 1 production systems and SLA credit structures will need to be improved.

- Accountability for Data Protection: Although SAP will provide a robust operational plan to protect data; UpperEdge suggests clients focus their attention on the liability SAP will assume in the event of a breach.

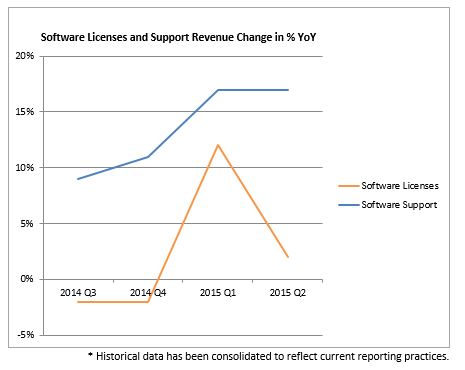

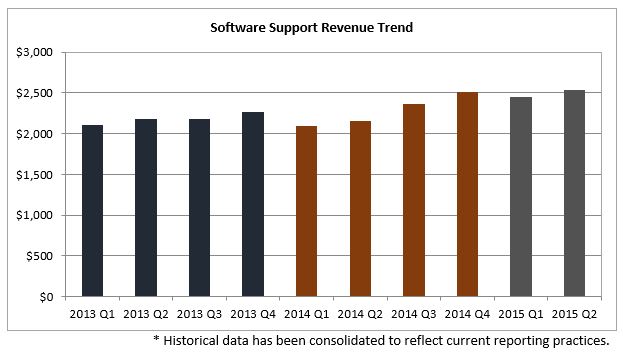

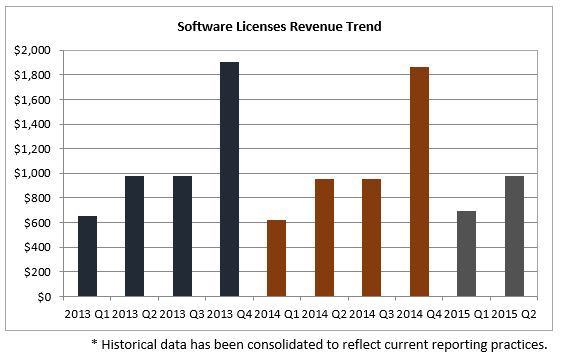

During the earnings call, Luka Mucic conveyed that the cloud business is not the only business ramping up. SAP continues to have a stable and growing curve with a 13% growth rate in Software Support and Licenses for the second quarter, however, the growth is primarily attributable to Software Support. SAP’s on-premise software license performance continues to show inconsistencies as the first quarter resulted in a 12% revenue increase in Software Licenses, whereas the second quarter revenue growth dropped to a mere 2% increase.

As expected, SAP follows a  common industry norm of producing much of its revenue in the second half of its fiscal year. In 2013 and 2014, SAP did approximately 64% of their Software License revenue in the second half of year. Based on SAP’s second quarter revenue performance and traditional purchasing trends, SAP is taking aggressive steps to set the table for Q3 and Q4.

common industry norm of producing much of its revenue in the second half of its fiscal year. In 2013 and 2014, SAP did approximately 64% of their Software License revenue in the second half of year. Based on SAP’s second quarter revenue performance and traditional purchasing trends, SAP is taking aggressive steps to set the table for Q3 and Q4.

What Customers Should Expect From Software Negotiations

It’s simple, software audits. SAP has made it clear to its customer base, via audits, that the “value” associated with its software extends beyond traditional SAP users and non-user based engines. More specifically, if you have custom developed software or third party software interfacing with SAP software (e-commerce, WMS, CRM, SRM solutions), your organization is very likely exposed to an SAP audit finding by way of indirect use.

Based on UpperEdge’s experience on this issue, we are advising customers to take a proactive approach to assessing their potential compliance exposure attributable to use through indirect access of SAP software. Customers with the following SAP relationship characteristics should consider themselves particularly exposed: (1) recent CIO turnover/ mediocre executive level relationships, (2) lackluster on premise software spend forecast, (3) best-of-breed on premise application strategy, (4) recent adoption of competitive Cloud solutions, (5) prior transition from Enterprise to Standard Support or to an alternative support provider, and (6) upcoming expiration of an Enterprise License Agreement.

Software Support

The second quarter marked the third consecutive quarter of double-digit growth for SAP’s Software Support line of business. This is significant because Software Support accounted for 51% of SAP’s revenue for the second quarter. The double-digit growth of 17% equated to a year-over-year increase of $373 million, while the Cloud’s triple-digit growth of 129% equated to $311 million.

What Customers Should Expect From Support Negotiations

Although many organizations are undertaking initiatives to reduce their software and hardware maintenance budgets, the reality for SAP customers is that SAP has very little flexibility or incentive to reduce a customer’s maintenance run rate. In the rare cases where such flexibility is afforded, it is typically coupled with significant investments triggering the Product Support for Large Enterprises (PSLE) threshold or investment in a product with a net license fee amount equivalent to or slightly greater than the requested maintenance reduction.

Tactically, UpperEdge recommends conducting a thorough optimization analysis of license utilization versus entitlements as a means to reduce incremental capital and expense spend. This can be accomplished via user and product exchange rights which may have been negotiated within your SAP contract. In addition, select customers may be able to leverage custom negotiated termination and suspension rights in the event future license utilization is not anticipated.

Services

SAP achieved 14% year-over-year growth in the Services line of business for the second quarter. UpperEdge believes this growth is attributable to two primary drivers. First, in April, SAP announced the restructuring of its consulting rates (K Rates to G Rates), coupled with associated rate increases. Secondly, UpperEdge is seeing SAP position its professional services in a more prominent role in support of multi-faceted transformation initiatives. More specifically, customers integrating SAP on- premise solutions with SAP Cloud solutions and/or undertaking custom development with SAP and integrating such custom development with SAP’s solutions are likely to be viewed as an ideal opportunity.

What Customers Should Expect From Services Negotiations

- Lack of Outcome-Based Contract Flexibility: Although SAP is interested in increasing revenue and monitoring the success of transformation programs, do not expect the flexible and outcome-based contracting practices afforded by traditional system integrators. To accomplish this with SAP, customers need a well thought-out negotiation strategy that is complimented by targeted market intelligence.

- Decoupling of Software Negotiations: Don’t let SAP decouple the software negotiation from any significant professional services commitment. At a minimum, get to a term sheet level with SAP and your preferred system integrator before considering this request.

- Rate Increases: Don’t feel comfortable with the verbal commitment to maintain existing K-Rates. Leverage second half software and cloud spend to secure future consulting rate protections.

Situational-Dependent Go-Forward Leverage

UpperEdge recommends customers take a holistic view of their relationship with SAP. If you are a heavily invested SAP customer, you can expect greater leverage with SAP during negotiations. Contributing factors are investments in Cloud solutions; steady and organic growth in software licensing; a migration toward S/4HANA; continuation of Enterprise Support; and leveraging SAP’s professional services. Customers who are not as invested or who have been moving away from SAP’s solutions can expect reduced leverage with SAP during negotiations and should evaluate their audit risk as SAP finds alternative means to offset their lost opportunity with you as a customer.

Comment below and learn more about our SAP Advisory Services.